As the digital era continues to transform the financial sector, account onboarding and maintenance have become critical challenges for banks. Customers are now demanding fast, seamless user experiences, while lenders face increasing pressure to comply with stringent Know Your Customer (KYC) regulations.

While digital onboarding can give banks an edge over rivals and boost customer loyalty, keeping up with KYC regulatory demands is paramount, not only to ensure compliance and avoid costly fines but also to prevent financial fraud and enhance security.

However, there has been a significant increase in anti-money laundering (AML) fines globally following the introduction of two major legislative measures: The US Financial Crimes Enforcement Network’s (FinCEN) Anti-Money Laundering Act of 2020 and the European Union’s 6th Money Laundering Directive of 2020. The two pieces of legislation have strengthened AML and combatted the financing of terrorism (AML/CFT) frameworks in their respective regions.

According to a report by PwC, titled Perpetual KYC: A new approach to periodic reviews, stringent KYC regulations mean that banks and financial institutions are obligated to routinely review and update the information they hold about customers. However, the surge in AML fines is often caused by backlogs and capacity constraints lenders face when trying to update customer profiles.

“While the effort imposed on banks for KYC compliance requirements differs by country, risk level, and customer type, it has overall grown by a factor of 14 times over the last decade,” PwC adds.

This has resulted in a growing interest in perpetual KYC, also known as event-driven KYC, a process that levels up the traditional method by allowing retail banks to offer continual automation for customers to update documents. This includes new identity cards, passports, and photographs that are about to expire without triggering another onboarding form-filling exercise or requiring them to visit a branch in person.

What is driving the evolution of pKYC?

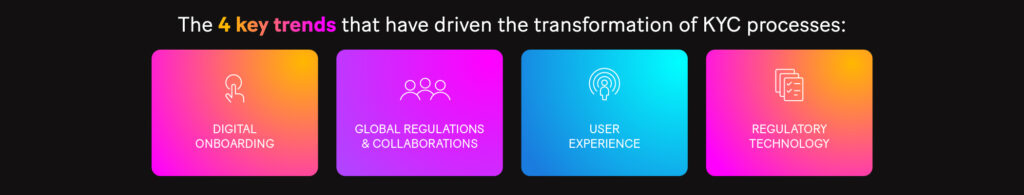

In recent years, four key trends have driven the transformation of KYC processes. They are:

- Digital onboarding: Previously, traditional KYC procedures required customers to lodge their identity documents at bank branches. However, the emergence of digital identity verification and electronic document submissions, particularly during the Covid-19 lockdowns, has made remote onboarding more common in the financial sector.

- Global regulations and collaboration: Digital customer onboarding has prompted the revision of existing laws and the introduction of new regulations worldwide to combat illegal financial activities. This global effort is being spearheaded by organizations such as the Paris-based Financial Action Task Force, the international watchdog for money laundering and terrorist financing. Additionally, this has increased information sharing related to KYC processes among financial institutions and central banks.

- User experience: The focus on enhancing the user experience in KYC processes is on the rise, with banks introducing user-friendly interfaces, clear communication of requirements, and seamless onboarding experiences in a bid to boost customer satisfaction and loyalty.

- Regulatory technology: In recent times, banks and other financial firms have increasingly adopted regulatory technology (RegTech) to enhance their KYC processes, allowing them to analyze data and automate tasks to better manage compliance and mitigate risks.

How does pKYC work?

The pKYC process is continuous and dynamic. It responds to specific events or changes in a customer’s profile rather than relying on fixed review intervals of, for example, one, three, or five years.

It involves real-time monitoring of customer accounts and activities, with banks able to automate predefined event triggers, such as a change of address, large transactions, soon-to-be expired documents, or other behaviors that may require a KYC update.

When a trigger event has been identified, alerts and notifications are generated to prompt a review, according to a report by Quantexa. “By adopting pKYC, financial institutions can enhance their ability to detect and respond to changes in customer risk profiles promptly,” it says, adding that this approach aligns with the dynamic nature of financial transactions and helps institutions stay vigilant against emerging risks and potential financial crimes.

What are the benefits of pKYC?

There are numerous benefits for banks that choose to implement pKYC. While the most obvious is meeting regulatory requirements and staying up to date with new laws, it also reduces operational costs and leads to better reputation management, according to Moody’s.

Banks can also customize their pKYC approach to match risk appetite. According to a research report by the ratings’ agency, three key benefits have the potential to “differentiate” a bank’s pKYC approach. These include a better user experience for customers, improved customer insights, and opportunities to cross-sell or upsell financial products tailored to customer needs.

“If these can be delivered, they are perceived as potentially transformational, with the ability to switch KYC from an essentially defensive activity into a more offensive, revenue-generating one,” it says.

However, there are also challenges to consider, as implementing pKYC requires advanced technological capabilities, which could be an issue for banks with outdated legacy systems that may not integrate easily with newer pKYC technologies.

In addition, banks must comply with data privacy regulations, address scalability issues, and achieve international pKYC standardization for global lenders, among other challenges.

However, the advantages of implementing pKYC outweigh the challenges, especially if banks take a strategic approach, work closely with regulators, and continue to invest in technology and compliance.

How Sopra Banking Software can help

Discover how SBP Digital Banking Suite can revolutionize your operations by addressing your pKYC, day-to-day servicing, and digital onboarding needs. With our comprehensive solution, you can boost customer acquisition, drive deposit growth and reduce customer risk, allowing you to shift your focus from manual onboarding to more significant areas like revenue generation.

Embrace the future of banking with the SBP Digital Banking Suite. Get in touch/book a demo now with our experts.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.