It’s no surprise that Generation Z is shunning traditional financial advisors and banks and turning to social media for advice, with short-form video app TikTok emerging as one of the leading global sources for money tips and investment information for this tech-savvy cohort.

The trend was initially fuelled by innovative, cashed-up youth during the pandemic lockdowns, as they sought ways to “get rich quick” by investing in stocks and cryptocurrencies and learning smart money skills on the fly.

Today, the global economic uncertainty and cost of living crisis are continuing to push the FinTok and MoneyTok hashtags to viral levels on the app. Combined, they have already garnered 16.9 billion views on TikTok, while investing videos have attracted about 11.7 billion views, according to data on the social media platform.

But it’s not just investing and trading advice that Generation Z, who are typically born between 1997 and 2012, is searching for on TikTok – they are also looking to boost their financial literacy skills by learning about student loans, how to tackle credit card debt, as well as saving and budgeting tips.

Generation Z and financial advice

While the popularity of TikTok has proliferated since its launch in 2016 and now has more than 1 billion monthly active users (MAU) globally, research has found that Generation Z is more likely to use digital platforms for financial advice compared with older generations.

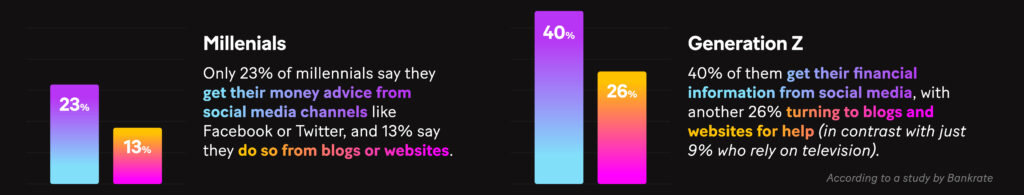

According to a study by Bankrate, only 23% of millennials say they get their money advice from social media channels like Facebook or Twitter, and 13% say they do so from blogs or websites.

However, that number jumps significantly when you look at Generation Z – 40% of them get their financial information from social media, with another 26% turning to blogs and websites for help (in contrast with just 9% who rely on television).

The economic power of Generation Z

In a 2022 blog post, the World Economic Forum noted that Generation Z relies on different values when evaluating their banking and investment needs than older generations, as they have also inherited Millennials’ lack of trust in “old-school financial institutions.”

This trend is evidenced by the follower counts of “finfluencers” on TikTok, which number in the millions, the WEF says.

Indeed, Generation Z’s economic power is the fastest-growing across all generations, according to a global research report by Bank of America, which projects their income to grow fivefold by 2030 to $33 trillion as they enter the workforce.

Engaging with Generation Z

But how do legacy banks tap into this growing audience and engage with Generation Z to win their trust and transform them into loyal customers?

The WEF says older financial institutions must do more than simply pivot to newer channels in the hope of attracting younger investors as they seek personalized experiences, similar to what they already find on TikTok, for example. “New platforms and apps unrelated to legacy corporations and specifically designed to appeal to upcoming investors and their needs are more likely to be trusted by Gen Z,” it adds.

However, governments are increasingly raising red flags over trust, privacy, and data issues related to several social media platforms, including TikTok. At the same time, many “finfluencers” lack the financial expertise to advise followers on investing or managing their money – and are often paid for their efforts by brands more interested in raising their profile rather than promoting fiscal responsibility towards consumers.

Experts say that financial scams are also rife on social media platforms, and Generation Z could risk losing their life savings.

The importance of trust and security

The rise in hyperconnected customers is already pushing banks toward a more personalized, secure, and environmentally conscious approach, according to research Sopra conducted in partnership with IPSOS and Forrester for our Digital Banking Experience Report 2022.

Our research also found that traditional banks continue to maintain high levels of trust among customers. This opens up a range of opportunities to differentiate themselves in the market regarding Generation Z, particularly in helping to educate them about financial literacy and responsible saving and investing.

“Gen Z prioritizes a personalized experience and sustainability and views omnichannel as trustworthy – platforms built with a focus on these features are the best way to increase the financial literacy of the next generation of investors,” the WEF says.

Meanwhile, for the most sophisticated banking customers, digital is no longer just a channel for interaction – it is expected to be a payment and finance management channel with high-added value.

Yes, banks are increasingly investing in new technology that allows them to focus on the wants and needs of hyper-connected customers. But they also recognize that the sector is changing quickly and they need to act fast to keep up with their rivals – and Generation Z, which is rapidly transforming traditional money management practices in this digital world.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.