Silicon Valley is known for many things, including being one of the world’s most prominent tech epicenters. The last few days, however, it has been known for something else entirely: The sudden shutdown of the long-standing, trusted Silicon Valley Bank.

In fact, this represents the largest bank failure since the 2008 financial crisis, which is now causing regulators and customers worldwide to re-evaluate the global financial system. SVB has a 40+ year history as a partner to the venture capital industry, where it has served the startup community while supporting the US innovation economy.

A big crisis with a huge impact worldwide

So, how does one of the biggest banks in the US collapse? For a myriad of factors, including rising interest rates, having less attractive bonds to sell, as well as fewer customer deposits; SVB ended up losing around $1.8 billion from selling U.S. treasuries and mortgage-backed securities in which it had invested in. To try to recover from this massive loss and stabilize itself, SVB planned to sell billions of dollars in common stock and convertible preferred shares. This caused a bit of panic among depositors, leading to an old-fashioned bank run, which resulted in the bank’s eventual collapse.

So, what does this mean for other banks and industries in the US, EU and worldwide? The failure of SVB resulted in a domino effect for other, mainly American, banks due to the fear surrounding the collapse. This has now largely been rectified.

By a significant margin, SVB’s main operations are in the US, making US-based companies the largest group to be affected by the bank’s failure. In contrast, around 30% of U.K. startups were initially at risk due to the failure of SVB and the potential collapse of their U.K. entity. Fortunately, HSBC quickly acquired Silicon Valley Bank UK, keeping the depositors’ money safe.

In terms of European impact, it’s estimated that $190 million from tech and life sciences companies are exposed following the crash of SVB in the US and the U.K… The impact in Asia-Pacific is lesser, but still present: Silicon Valley Bank backed many Indian startups, meaning their money was tied up in the bank. Furthermore, many companies that moved their US base to India had their money in SVB.

How and when can regulators intervene to save a bank?

The sudden failure of SVB has made people around the globe take a closer look at policy implications, and really question where companies, especially startups, should hold their money.

So, why do banks actually fail? Banks fail for multiple reasons including bad investments, not enough deposits and a bank run – when a sudden, large number of account holders take out money quicker than the bank can handle. To rectify a bank failure (and avoid it in the first place), regulators are incredibly important. In the United States, the regulatory officials responsible for overseeing that banks are following laws, ensuring that they are not taking a dangerous amount of risk, and supervising banking operations, include the Federal Reserve System, the FDIC, the Office of the Comptroller of the Currency (OCC), and the state banking agencies.

In the EU, The European Banking Authority (EBA) is responsible for regulating the banking activities across all EU countries through a standard set of rules.

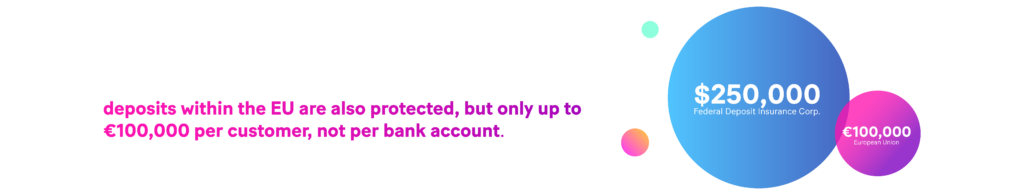

When a bank fails, there are a few things regulators can do. As we’ve seen in the case of SVB and Signature Bank, US regulators can shut down a bank, sell it or even take it over themselves in the short term, consequently freezing the accounts until further notice. Alternatively, they can also protect and guarantee the funds in depositors’ accounts, which is important to ensure people have continued trust in the banking system. The Federal Deposit Insurance Corp. (FDIC) ensures up to $250,000 for each depositor account. In some cases, the FDIC will fully guarantee all deposits when a bank fails (without using tax revenue), which happened with SVB.

In the EU, if a bank is likely to fail or already declared to be failing, the bank is taken over by the Single Resolution Board (the authority for significant banks as part of the European banking supervision.) They will either work towards a bank resolution if there is a large public interest in preserving it, or the bank will be liquidated. EU regulators have the authority to sell parts of the bank, transfer its assets or cancel liabilities. Similarly to the US, deposits within the EU are also protected, but only up to €100,000 per customer, not per bank account.

Changes to come for banks, now and in the future

Regulators have asked SVB employees to continue to work for the next 45 days at a rate of 1.5X their existing salary, while they try to re-stabilize the situation. While it’s clear that the US Federal Reserve did everything possible to maintain global confidence in US banks, both the US and European markets have reacted in fear, and it will take a bit of time for the dust to settle and for depositors to regain confidence in the global banking system.

While it’s only natural for an event such as this to make us worry, it should also simultaneously restore our faith in banks, as regulatory officials and financial institutions rallied together to protect account holders and their deposits. Regardless of the actual facts however, this event will likely motivate some individuals to diversify where they place their money, to ensure they are below the regulatory insured limit in the event a bank fails again.

This could be through depositing some of their funds in other banks, or even outside of banks entirely through crypto, getting cash out, or investing in other safe, liquid options.

Rebuilding customer trust, a priority for banks

The failure of SVB will also likely lead to an increase in bank distrust, as those that had deposits greater than the (FDIC) insured limit of $250,000, which is common for corporations, must wait until there is enough liquidity for them to be paid out. In this exceptional case, the FDIC guaranteed all deposits, but legally they aren’t required to do so above the insured limit.

In order to rebuild customer trust, banks need to give their account holders reassurance that even if there is an unlikely bank failure, all of their deposits are guaranteed. It’s widely accepted that without confidence, the banking system will fall apart. With this reassurance, customers will be less likely to move large amounts of money outside of banks.

In the US they are working towards providing this security, through a new emergency program that would give banks and credit unions nationwide the ability to cover all deposits if needed. This “Bank Term Funding Program” gives one-year loans to banks that pledge collateral including mortgage-backed securities and Treasury bonds.

Since there is overall a greater level of regulation in Europe regarding the ways banks can invest and manage funds, and the level of information customers must be provided, there is a bit more protection against these kinds of situations from arising here. Though SVB failed in the US, in our interconnected age the repercussions will be felt worldwide.

As such, The EU should come up with a similar measure to ensure customers are comfortable keeping more than €100,000 in banks (the insured limit), so that they are fully protected in the event of a bank failure, however unlikely that may be.

While the failure of SVB was unexpected, this experience should teach us to keep faith in the banking sector. Although banking failures happen, they are rare. Many situations either self-correct through regulatory intervention or through the market itself. It’s important to not let fear cloud our judgment and to be comforted knowing that banks are well-regulated and are one of the safest places to keep and invest money.