Request-to-Pay (RtP) is sometimes referred to as the “missing link” in the world of payments, and it will be a vital part of banks’ payment strategies for years to come. At the Sopra Banking 2021 Summit, our experts did a deep dive into what the scheme means, for industry players and customers alike. In this article, we cover some of the main topics.

What is RtP and what are its main characteristics?

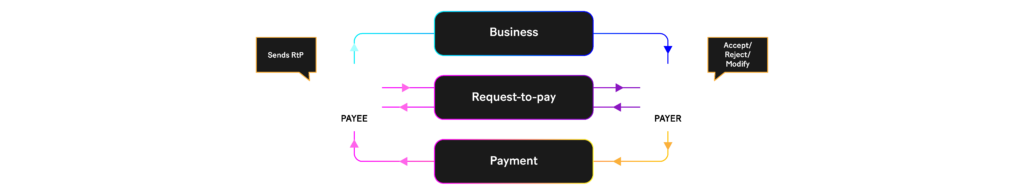

RtP is often classified under the umbrella term, “direct payments.” There is nothing wrong with this, but it can sometimes overlook the specific characteristics of RtP. They go much further than just sending a payment request.

The characteristics of RtP unequivocally demonstrate what options this method of payment offers banks and their clients:

- A dialog takes place between the payer and the recipient in realtime. This creates a new communication channel for payments.

- With an RtP, all payment details, including an invoice in some cases, are sent together and uploaded to the payment environment of the recipient. As a result, no mistakes can be made due to, for example, a typing error when entering payment details.

- Flexible payment methods can be easily arranged through an RtP. From a deferred payment to payment in instalments.

Why should banks offer their own RtP option if there are already so many services available?

There are already many Payment Service Providers (PSPs) that offer RtP services. As a result, banks offering these services themselves may seem superfluous to requirement. After all, what benefit is there to the banks in competing with major international parties such as Apple Pay, Klarna or Paypal? More importantly, what is the advantage for the client?

At the time of writing, most of the RtPs worldwide still go through third parties. These are fintechs or big-tech companies that do not possess a banking license and operate outside the banking ecosystem. This also means that an RtP often takes place outside the safe environment of the bank.

When banks themselves offer RtP services, their clients no longer have to affiliate with third parties. This offers more ease of use for the client and represents a means by which banks can optimize the customer journey (without the intervention of third parties). The bank, as a one-stop shop for payment services, has the opportunity to maintain contact with the customer and generate extra income.

This issue can no longer be avoided because RtP is currently being embraced by the Berlin Group. This group of representatives of nearly 40 banks, payment associations and PSPs is stimulating the development of its own APIs for RtP at banks. RtP has not been the standard within the European Union for very long.

RtP is not only interesting for consumers, but offers opportunities for use cases between all conceivable parties: manufacturers, retailers, consumers among themselves and governments can enter into a payment dialog. Banks do not want to be excluded from all of these payments because, as is often the case now, they go through third parties. Offering your own RtP service is almost a condition for banks to participate in the payment landscape.

What RtP challenges are banks facing?

If it were simple, banks would already have had their own RtP services up and running for a long time. This is not the case, and banks are facing a number of major challenges, which we’ll cover below.

- Implementation

The implementation of a new payment service is not easy. This is particularly true if it is built within an IT infrastructure with a long history. The costs of such implementations can quickly increase. - Complexity due to different use cases

As many different use cases are possible with RtP, this also means that the implementation of all these options is complex. Modules must be built that are suitable for the direct payment and invoicing of, for example, the plumber, but also for governments that, for example, want to collect fines through RtP. - Enrichment for added value

To make an RtP service attractive and user-friendly, it is essential to enrich it. The so-called added-value services work primarily if they meet the needs of the end users. Capacity is needed to develop these. - Legislation and regulations

Legislation and regulations with regards to payments and RtP are growing in line with technological developments. This is an extra task for banks, which have already spent a lot of time and incurred significant costs on compliance. - Instant fraud detection

Know your customer (KYC) and payment security are paramount at banks. As RtPs take place in realtime, the fraud detection must also be performed immediately. The development of the modules required for this is complex and expensive. - What is the ROI?

It is not easy to predict how quickly consumers will pick up on RtP services. As a result, it is not only difficult to determine the correct priority when implementing the various use cases, but also to determine in advance what the scope of an RtP service should be.

The solution for banks that want a customized solution with a lower risk

One thing is certain: clients are often prepared to pay for better digital services. With banks well placed to provide such services, they can recapture a part of the market from third parties through RtP services. At the same time, banks can improve the customer experience through RtP services and generate extra income through this new channel.

Although banks within the European Union can no longer avoid the issue, the provision of RtP services is not an option for every bank due to costs and development capacity. Small and medium-sized banks, in particular, are facing a challenge. For these banks, Sopra Banking offers several scalable API solutions that will grow in line with demand and will always meet the latest legislation and regulations.

Click here to find out how Sopra Banking solutions can help you.