The number of challenges that legacy banks are facing is stacking up: Keeping pace with new and changing regulations; loss of market share caused by struggling to meet the needs of digital and non-digital native consumers alike; maintenance of outdated systems. They’re all issues that banks have to contend with.

And while new industry entrants are also up against problems of their own, they’re often immune to some of the issues faced by their incumbent competitors.

To remedy this, many legacy banks look to their modern, more agile competitors for inspiration, and digital transformation is often at the heart of their strategic response. By digitizing their existing processes – and doing so at speed – and offering customers truly digital, innovative products and services, they hope to beat the digital banks at their own game.

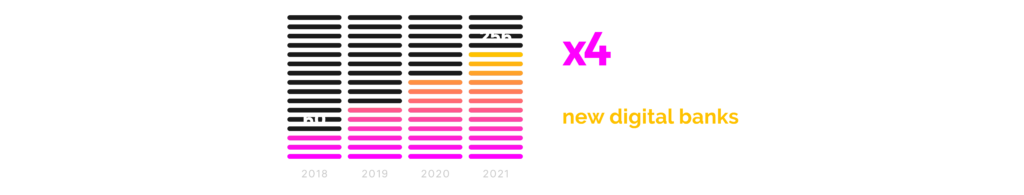

Likewise, non-legacy bank organizations sense an opportunity. The number of new digital banks being created has risen exponentially in recent years, quadrupling from 60 worldwide in 2018 to 256 in January of this year.

Nevertheless, whether it’s legacy banks looking to accelerate their digital transformation or new industry entrants interested in building something from scratch, the question remains: How can you build a digital bank?

Getting started with building a digital bank

Unsurprisingly, building a digital bank – either from scratch or from an existing infrastructure to become truly digital – is no mean feat, and there are plenty of obstacles along the way. (We’ll come onto those later).

But first, it’s important to identify what exactly qualifies a truly digital bank, and the steps that need to be taken in order to create one.

What is a digital bank?

At a quick glance, a digital bank is simply an organization that provides traditional banking services via a computer or mobile device. Indeed, the core products and services offered by digital banks don’t necessarily differ from those of their incumbent competitors. However, there are some key differences that set digital banks apart.

For a start, digital banks tend to target digital native customers who, oftentimes, feel neglected by legacy banks. Some important customer needs met by digital banks include:

- Transparency. Digital banks rarely have hidden or excessive fees

- Experience. Digital banks typically offer fast and easy-to-use services and support

- Accessibility. Digital banks often allow their customers to access their services at any time, from anywhere

Targeted customer-centric service is at the heart of what makes a digital bank. Rather than resting on their laurels, digital banks are known for continuously adapting their value proposition to better meet the needs of the market. Fidor bank, for instance, has focused on customer engagement by giving customers a voice in how the bank is run, by “discussing the future interest rates, or naming the current account card that the bank will use.”

Such an approach has reaped rewards, even during the pandemic. In the US, for instance, the number of customers served by digital banks rose by 40 percent from 2019 to 2020, per a recent Forrester report.

By offering user-friendly and relevant services, digital banks can set themselves apart from their incumbent competitors. It’s both the definition of what makes a digital bank and part of the key building blocks required in building one.

Challenges in building a digital bank

It’s easy to say that building a digital bank is the future, but there are of course challenges.

First and foremost, acquiring customers, deposits and active accounts is always the biggest hurdle to overcome, especially getting money into the system to begin with. Offering prospective customers with USPs and attractive products and services (such as those mentioned above) is a great place to start, but building such a strong portfolio can be time consuming and costly.

There’s also the red tape to bear in mind. While it differs from region to region, banking is an extremely regulated sector, and there are plenty of administrative hoops to jump through. This can be a lengthy and expensive process, which is why many emerging digital banks often partner with legacy banks. The US-based digital bank Chime, for instance, partnered with Bancorp, who provides the banking license and deposit insurance.

Of course, legacy banks wishing to go digital are less concerned with banking licenses and building a customer base from scratch, but they do have different challenges to overcome.

Many legacy banks have cultures and technologies that are difficult to change. Becoming truly digital means having agile technology capable of continuously adapting to an ever-changing market, as well as having an open culture of change within the organization. And in the same way that creating the building blocks of a digital bank can be time consuming and costly, so can implementing the change to go truly digital.

Building out a roadmap

Clearly, launching a digital bank is far from easy. There are plenty of boxes to tick and potential problems to be navigated. Furthermore, launching a digital bank is by no means a guarantee for digital success. The market is becoming increasingly crowded, and plenty of digital banks have already failed, including Bo by Royal Bank of Scotland, Finn by JPMorgan Chase and Greenhouse by Wells Fargo.

It’s therefore vital to approach building a digital bank in the right way. We believe that approach starts with putting together a roadmap. On a macroscale, this involves outlining the objectives, mission and vision, and identifying the short and long-term values to be achieved. On a more detailed level, it’s about research and testing – identifying target segments, understanding customer needs and pain points, and using that data to create high-value USPs.

Building iteratively on this type of approach – including listening to and acting on customer feedback – gives organizations the best chance to succeed.

Of course, putting together and following a roadmap toward building a digital bank is, in itself, not self-evident. Organizations need to understand the intricacies around it, such as customer journey, technical architecture, the associated costs and licenses involved. That’s why having the support of an experienced and trusted partner during this process is crucial.

As is becoming increasingly the case in the banking world, partnerships here may be the key to survival. Banks and organizations need to seek out tried-and-tested expertise in order to help them build out their digital roadmaps, as going alone will not be successful.

Need help building a digital bank or transforming an existing one? Check our Digital Banking Suite and digital advisory