In today’s rapidly evolving financial landscape, banks face mounting pressure to embrace marketing automation strategies to gain a decisive edge in the market. As traditional marketing approaches fall short of meeting changing customer needs, personalized interactions, and real-time services have become imperative.

Marketing automation helps automate and streamline marketing tasks across various channels, facilitating personalized customer interactions, efficient lead generation and targeted content delivery to drive engagement and business growth.

Automated marketing also allows banks to leverage high-value data to create hyper-personalized campaigns, tailored product recommendations, and financial advice. Moreover, it has the potential to identify and help customers facing financial hardship, bringing about a dramatic shift in customer involvement.

However, the journey towards marketing automation is riddled with challenges, chief among them being data privacy, compliance regulations, and system integration. Central banks’ efforts to protect consumer privacy require banks to navigate these hurdles carefully while integrating automation into existing IT frameworks.

Despite these challenges, automated marketing has great potential. Advancements in artificial intelligence (AI) and machine learning promise unparalleled benefits, enabling predictive analytics to anticipate customer needs and personalize responses based on behavior, surpassing traditional chatbots and virtual assistants.

The value proposition of automated marketing is underscored by its potential to drive customer growth, enhance engagement, introduce innovative products and services, and streamline operations—leading to higher profits for banks.

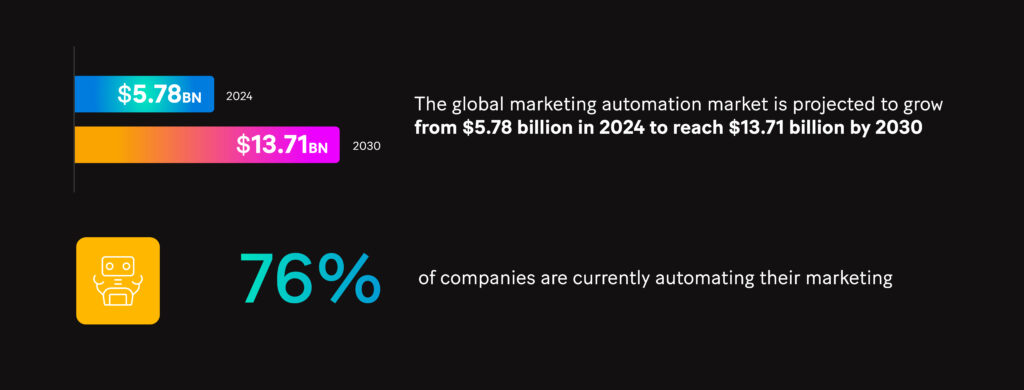

Industry forecasts paint a promising picture. The global marketing automation market is projected to grow from $5.78 billion in 2024 to reach $13.71 billion by 2030. 76% of companies are currently automating their marketing, and 10% of customer journeys are fully automated, signaling a seismic shift in marketing paradigms.

Recent reports from McKinsey Global Institute and Capgemini also emphasize the disproportionate benefits the banking sector can gain from AI-driven marketing automation. The transformative potential of generative AI is particularly pronounced. McKinsey estimates suggest annual gains of $200 billion to $340 billion, or 9% to 15% of operating profits, primarily driven by heightened productivity across corporate and retail banking segments.

McKinsey’s analysis underscores the broad economic benefits expected across all banking sectors and functions, notably highlighting the substantial gains forecast in corporate and retail segments, valued at $56 billion and $54 billion, respectively.

Amid a volatile economic landscape, Cap Gemini’s World Retail Banking Report 2024 underscores banks’ commitment to digital transformation, balancing customer experience enhancement with operational efficiency refinement. However, the report warns of delayed development in key performance indicators (KPIs) critical for evaluating generative AI’s impact on marketing strategies.

The report stresses the critical need to evaluate the impact of generative AI across multiple strategic dimensions to ensure alignment with organizational objectives and benchmarks.

Despite these hurdles, a 2023 report by Forrester showed that 47% of banking decision-makers plan to integrate generative AI or large language models (LLM) into operations, with a focus on emerging technologies like chatbots and virtual reality to enhance customer engagement.

However, concerns persist over the effectiveness of chatbots in delivering satisfactory user experiences, with anticipation for AI and LLM models to provide more compelling conversational experiences.

Key features of automated marketing

In the realm of automated marketing, three key features stand out and offer banks a number of benefits:

1. Lead management: Automated marketing empowers banks to streamline lead capture, tracking, and nurturing processes. Banks can segment leads based on demographics, behavior, and engagement levels, facilitating highly targeted and personalized communication. Additionally, automated lead scoring and qualification mechanisms enable banks to prioritize high-potential leads to optimize sales efforts.

2. Multichannel campaigns: Marketing automation systems, as highlighted by Forrester, equip banks with the capability to engage customers across various channels such as email, SMS, social media, and push notifications. Automating campaigns ensures consistent messaging and enhances customer experiences. Forrester reports that 48% of marketers aim to improve customer experiences using conversation intelligence, refining ad targeting, email campaigns, website personalization, and more.

3. Workflow automation: Marketing automation platforms feature intuitive workflow builders for automating various marketing processes, including lead nurturing and cross-selling. These workflows, tailored based on customer behavior and predefined rules, ensure timely and relevant communication.

What are the benefits of marketing automation?

The advantages of marketing automation for banks are numerous, spanning streamlined operations, enhanced customer experiences, efficient lead management, proactive engagement, informed decision-making, revenue maximization, regulatory compliance, and cohesive brand representation.

Automation diminishes manual tasks, analyzes customer data for personalized recommendations, streamlines lead conversion, maintains continuous customer connections, and refines marketing strategies with data insights. It also identifies revenue opportunities through behavior analysis, ensures regulatory compliance, and provides consistent messaging across all touchpoints. These benefits contribute to heightened operational efficiency, elevated customer satisfaction, increased revenue, and fortified brand identity in today’s competitive landscape.

By embracing automation, banks can enhance the customer experience, fuel business growth, uncover new opportunities, provide customized services, and monitor strategy effectiveness.

What challenges do banks face?

Banks face challenges in adopting marketing automation, including data privacy and security concerns, system integration complexities, regulatory compliance, employee training, and effective data management.

Ensuring the security of sensitive customer information is crucial, requiring robust data protection measures and adherence to stringent regulations. With cyber threats on the rise, increased cybersecurity spending is imperative to mitigate risks. According to the IBM Cost of a Data Breach Report 2023, the average global cost of a data breach last year totaled $4.5 million, a rise of 15% compared with 2020 – prompting 51% of organizations to say they would increase cybersecurity spending in 2024.

Additionally, integrating marketing automation platforms with existing IT systems poses challenges, requiring meticulous evaluation and seamless integration to optimize data flow. Banks must prioritize compliance with central bank regulations, demanding investment in change management and employee training.

Establishing strong data governance processes is essential to maintain data integrity and transparency. Despite the potential for enhanced personalization, maintaining customer trust is paramount, requiring transparency in data usage practices and continuous monitoring and refinement of automation initiatives based on analytics insights.

Future trends in automated marketing

Staying ahead of the curve in adopting emerging technologies is imperative for banks to maintain their competitive edge, embrace innovation, and propel growth. Four key trends are set to redefine automated marketing:

- Integration of AI-powered personalization and omnichannel experiences to craft seamless customer journeys.

- Next-generation decision engines capable of real-time analysis of digital and offline data, facilitating personalized recommendations and offers.

- Adoption of voice-enabled devices and conversational interfaces to elevate customer engagement and accessibility.

- Implementation of automation to streamline compliance processes and bolster security measures, safeguarding sensitive customer information.

A transformative solution

Marketing automation has immense potential to revolutionize the banking sector. Streamlining critical functions such as lead generation, customer onboarding, and identifying cross-selling opportunities empowers banks to enhance customer engagement, improve conversion rates, and ensure compliance.

Marketing automation also enables personalized communication, proactive support, and targeted offers to foster long-term customer relationships. By leveraging data-driven insights, banks can refine strategies for optimal results, driving efficiency and growth and delivering enhanced customer experiences.

Overall, marketing automation emerges as an essential tool for banks to navigate the complexities of an increasingly challenging market, paving the way for transformative changes in banking operations.

How Sopra Banking Software can help

Traditional banks can learn from the success stories of neobanks, be it their speed, agility, and willingness to leverage digital and open banking. Or their hyperfocus, use of new technology, focus on providing best-in-class customer journeys, and data-centric culture. Sopra Banking today provides solutions designed to understand and extend such capabilities.

Click here to learn more about Sopra Banking Software’s AI based solutions that help to leverage data to further enable hyper personalization…

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.