As the automotive industry undergoes rapid transformation, traditional financing players must adapt to meet the new demands of customers, who are constantly seeking greater flexibility. This is a major challenge that opens the door to new opportunities for those ready to take it on.

Since the beginning of their existence, automotive manufacturers and finance companies have experienced three significant evolutions. The first dates back to the 1980s with the advent of car financing, which became widespread, forcing the main car groups to transform themselves into finance companies. The second began in the 2000s, when these same car finance companies evolved into leasing operators, opening up car leasing offers to the general public. The last evolution, currently underway, responds to the new concept of mobility as a full-fledged service, sometimes combining several means of transport, and forces these companies to become service providers.

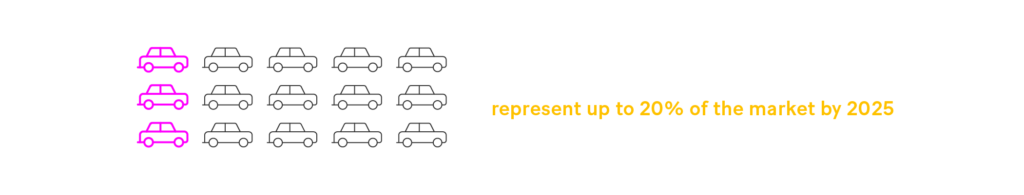

The world of automotive financing is changing. The market is growing rapidly, and consumer behavior is driven by two trends: digitization and personalization of services, as seen in other sectors. There has also been a paradigm shift in mobility: cars are no longer purchased in the same way, and leasing (with or without an option to buy) now drives the market. According to McKinsey estimates, automotive subscription seems to be the next step in this transformation and could represent up to 20% of the market by 2025. This means that traditional players must change their business models to leverage this new environment.

A sector where digital has become essential

In this digital era, where customer experience is central to success, all sectors must offer individualized, fast and easy-to-use services – and the world of auto financing is no exception. Users value self-service and online services more than ever, and the transition from physically visiting the dealership to shopping online for options must be seamless. Consequently, new entrants to the market often have a head start and are able to meet these expectations more readily. Traditional players face a number of difficulties:

- Obsolete IT systems that are not adapted to today’s requirements and that require a costly overhaul

- Insufficient data analysis capabilities to meet the demands of Big Data

- Lagging innovation, as the market has long been driven solely by the sale and leasing of vehicle

- Slow response to changing regulations

If today’s automotive finance companies do not act, they risk losing profits.

The next revolution in the automotive industry: from finance company to service provider

To optimize revenue, reach out to customers and keep up with new players in the industry, automotive finance companies need to improve the customer experience and the finished product. Several paths of inquiry already exist:

- Develop innovative new financial products, such as flexible subscription formulas, short contracts and pay-as-you-go options

- Bundle financial services into “all-inclusive” packages (maintenance, insurance, concierge service, electric vehicle accessories, even Mobility-as-a-Service, etc.)

The aim is to offer the customer a variety of customizable products. This adaptability to demand also involves a direct link between the captive companies and the customer. Historically, captive companies’ revenues were generated by dealerships, but the digital age offers them the opportunity to create a relationship with consumers via direct sales. A growing proximity that may soon become a prerequisite for captive companies.

A paradigm shift supported by structural changes

Automotive financiers must choose where they want to position themselves in the value chain and evolve their corporate culture to place more emphasis on innovation, the customer and data management and analysis. To do this, they must ensure the resilience of their IT systems and focus their strategy on digital and Big Data.

Finally, it is in their best interest to understand local legislation when designing new products, especially for “bundled” products. For example, the European General Data Protection Regulation (GDPR) limits access to certain information, while the United States makes it mandatory to go through the dealer.

These challenges and investments will strengthen their relationships with customers and ensure their place in the automotive ecosystem.