It’s understandable that many are viewing 2023 with trepidation, after the economic uncertainty of 2022 that saw the outbreak of war in Ukraine, an energy crisis, political upheaval in the UK, and significant disruptions to the global supply chain. Those economic headwinds have continued in 2023, along with high inflation, the cost-of-living crisis, and a possible recession.

Despite the challenging environment, the outlook for the automotive finance sector appears positive over the next decade and is expected to recover from the pandemic-induced dip in lending and rise in loan delinquencies caused by widespread job losses and consumer concerns over meeting car payments.

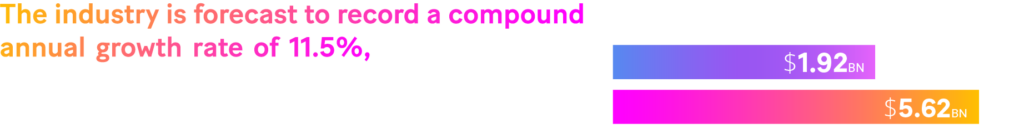

Indeed, while the pandemic had a negative impact on the growth of the automotive finance market, lenders also experienced a surge in servicing activities, such as refinancing and extensions, and adopted digital tools to complete processes remotely, Allied Market Research says in its analysis of the industry for 2022-2031. Furthermore, the industry is forecast to record a compound annual growth rate of 11.5% and will surpass $5.62 billion by 2031, up from $1.92 billion in 2021, according to the same analysis.

Other elements driving the surge in growth over the next decade include an increase in the world’s population, urbanization trends, large investments in electric and autonomous vehicles, and prompt financing and financial inclusion programs, according to TransUnion’s 2023 Consumer Credit Forecast. “Consumer demand for vehicles is likely to remain strong, and an expected improvement in inventory shortfalls should drive an increase in auto originations over the course of the year,” Satyan Merchant, senior vice-president and auto business leader at TransUnion, says in the report.

With these differing points in mind, we look at the key trends expected to disrupt the automotive finance industry’s evolution in 2023.

Changing customer expectations in the digital age

Many customers now expect fast, easy-to-use, personalized digital services across all sectors, including automotive finance, while a seamless customer experience will go a long way in boosting the sector’s growth and revenue.

However, this could pose a problem for incumbent automotive financers, which have fallen behind on digital innovation because their IT systems are no longer fit for purpose, Deloitte warns in its Core Businesses for Automotive Captives in 2030 report.

Incumbents with aging IT systems that are unable to leverage existing data are likely to neglect innovation and will struggle with regulations amid a rise in new entrants and captive lenders that are better able to meet customer expectations by building their own payment functionalities and using artificial intelligence to capture valuable data, Deloitte adds.

Therefore, incumbents need to introduce new technologies and update their IT systems to better compete in what is becoming a very crowded market, otherwise, they face stalled or declining revenues.

Regulatory changes: the UK case

Meanwhile, inflation, higher interest rates, and the rising cost of living will continue to be important issues for automotive financers in 2023, with disposable incomes expected to be impacted amid slowing sales and new regulations designed to protect customers.

According to a report by Motor Finance Online, the cost-of-living crisis in the UK has arrived at a time when the sector is reassessing how it relates to customers and its responsibility towards them after the Financial Conduct Authority announced its Consumer Duty program last year.

The Consumer Duty will come into effect this year and the FCA says it “sets higher and clearer standards of consumer protection across financial services and requires firms to put their customers’ needs first.” Despite the introduction of Consumer Duty, automotive financers say there will not be a significant change in how they do business.

Reducing total cost of ownership (TCO) and speeding up time to market (TTM)

Within the current economic context, the rise of new competition and evolving customer demands, financial institutions are under pressure to reduce their total cost of ownership (TCO).

As discussed in our previous article, TCO is the overall cost of a product or service throughout its lifecycle, combining direct and indirect costs. By knowing the TCO of a product or service, financial institutions can improve efficiency and drive down costs with industrialization, outsourcing, and other cost-cutting techniques.

However, simply cutting costs is not enough given the current economic climate and the rapid pace of the digital economy. This means that the cost-to-income ratio should be controlled on top of the TCO to ensure that products and services are economically viable. To remain profitable, financial institutions need to reduce costs and time to market (TTM), of which open banking is a potential enabler.

In fact, financial institutions and software providers are becoming more active in the open banking ecosystem, which enables them to accelerate product development and lower cost and income ratios with new, future-proof, and scalable revenue streams.

Environmental concerns

On the surface, the automotive industry and green financing may seem contradictory, but they are becoming more connected as consumer awareness grows about the impact of climate change on the environment.

Regulatory reforms, including the requirement that automakers cut emissions and the emergence of financial instruments like green bonds, are among the factors that are advancing sustainability and solidifying the relationship between the two sectors. Add to this the fact that institutional investors are increasingly incorporating environmental, social, and governance (ESG) considerations into their financial decisions.

By providing favorable green loans and educating consumers, lenders are increasingly contributing to the sustainability agenda; reducing emissions not only benefits the environment, but also contributes to the success of financial institutions and builds trust with environmentally aware customers. Automotive financers can achieve this by digitalizing core processes, such as conducting emission-heavy audits remotely, which will eliminate the need for trips by train, plane, and cars.

Innovative financing for low- and zero-emission vehicles is also gaining in popularity, particularly in the UK, where lower taxes are being levied on company-provided electric cars. Electric car leasing company LoveElectric’s salary sacrifice financing plan is a good example of innovation and how government regulations to cut emissions is shaping the market. Salary sacrifice is a benefits scheme that allows employees in the UK to pay for a car – or even a bike, childcare, healthcare, or gym membership – out of their gross monthly salaries.

The installment comes out of their pay before tax, thereby reducing their salary but also lowering the total amount they pay toward income tax and national insurance payments. This is money that employees would not normally see, as it is typically deducted from their pay in tax. Instead, it goes directly toward paying for an electric car under the salary sacrifice model. This is very cost-effective way to lease an electric vehicle and also allows customers to save up to 40% on the cost of the car.

The automotive financing revolution

Despite the disruptive economic headwinds and new regulations, automotive financers have many opportunities to propose innovative offers to improve their financial resilience, compete with new entrants, and meet new customer demands.

At the core of this is the customer, and being able to offer services that enhance their experience with the final product. Examples of this include:

- Subscription and usage-based payment models.

- Flexibility rates.

- Bundled finance products that could include maintenance, insurance, or concierge services, as well as products for electric vehicles.

- Mobility-as-a-Service (MaaS) to integrate different types of transport services into a single mobility service that is accessible on demand.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.