Platformification is the principle of building systems that are as open as possible, and therefore easily connectable to different capabilities, while maintaining a high level of security and leveraging existing solutions. This concept incorporates technologies like mobile-first, blockchain, the cloud, artificial intelligence, and the Internet of Things. Each provides a valuable building block, but when combined, truly end-to-end customer journeys are possible.

In an age of fintechs and big tech, the future is bright for financial institutions (FIs) that are able to leverage the trust earned from their customers, while adapting to their ever-changing needs by harnessing the power of open ecosystems. By using this approach, FIs can reduce costs, speed up time to market, improve the customer experience (CX), and keep pace with tech-savvy competitors.

Below, we explore platformification as part of the answer for financial providers – a way to keep up-to-date with the fast-paced and unpredictable world we’re currently living in.

Change and economic uncertainty

Since the global pandemic and the acceleration of digital transformation, the new “normal” is laden with economic uncertainty and constant change. The impact has been an ever-increasing need for companies to learn to adapt – quickly.

A strategy of collaborating with trusted third parties and harnessing the power of open finance is one of the best options for FIs to compete in this rapidly evolving environment, because it allows them to continue using legacy systems while incrementally adding new and innovative services that put consumers front and center.

Customer needs are shaping financial institutions

Consumers these days are comfortable navigating a digital world, and their habits have quickly changed to mirror this new way of consuming and interacting with service providers. It’s opened the way for fintechs, tech giants, and other third parties to enter the banking industry, making it easier for people to switch providers to one that offers a top experience and value-add services.

As a result, traditional FIs should adapt their infrastructure and processes to better leverage the data they already have and produce relevant data insights, create more personalized offers, and meet evolving customer requirements.

To move closer to their customers’ expectations, FIs also need to make faster decisions without taking on too much risk, while maintaining acceptable operating costs. Digital transformation comes into play here. In an era when individuals and businesses desire agility and quicker interactions, financial institutions are under immense pressure to embrace technology and provide a seamless customer-centric experience.

Luckily, they don’t need to take sole responsibility or find a one-size-fits-all solution. Instead, they can turn toward a platform or ecosystem approach one step at a time, based on priorities.

Leveraging ecosystems to better serve customers

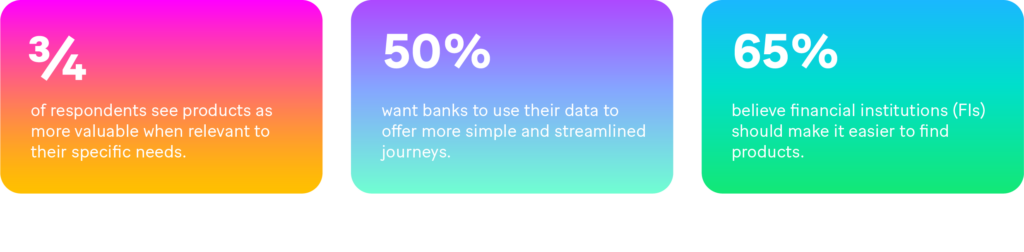

Banking customers demand ease of use alongside tailored experiences that cater to their unique and ever-changing needs. According to a survey by Forrester, almost three-quarters of respondents see products as more valuable when relevant to their specific needs.

Furthermore, over 50% want banks to use their data to offer more simple and streamlined journeys. On top of that, 65% believe FIs should make it easier to find products.

For financial institutions, developing bespoke data-driven experiences is an excellent way to win new and retain existing customers. Although it may seem like a daunting task, a platform-based approach is an accessible method to face the challenge head-on. Indeed, among other things, platformification enables customer-centricity, breaking existing silos and allowing information and insights to flow more easily.

Platformification: enabling FIs to thrive in the modern era

Platformification also helps traditional banks adapt as customer demands shift. As per Ron Shevlin, Chief Research Officer at Cornerstone Advisors, it’s a “plug-and-play business model that allows multiple participants to connect to it, interact with each other, and exchange value”. That’s where the importance of ecosystems and open finance comes in, allowing institutions to combine historical data with modern software to craft a first-class and hyper-personalized CX.

By going down the platformification route, scalability challenges, fragmentation, and the complexities of traditional integrations significantly reduce through APIs (application programming interfaces). As such, banks can unlock real data value, alongside simplifying and optimizing online processes by introducing innovations quickly and securely. Thanks to platformification, a myriad of microservices can be leveraged, allowing banks to rapidly integrate new capabilities as and when required.

Furthermore, through platformification, banks work with trusted partners that offer diverse services, ensuring they remain competitive without taking on greater risk.

Platforms help traditional financial institutions embrace technology

To provide customers with an outstanding level of service and state-of-the-art products, FIs must continuously evolve. That involves utilizing existing core systems alongside collaborating with inventive and tech-forward third parties, without having to rip and replace everything in one go.

With platformification, there’s no need for costly and frequent internal reprogramming or new app development. Instead, services are managed by resilient and reliable software providers, including security requirements and regulatory compliance. In turn, FIs free up time and resources to focus on what they do best – banking – while the vendors provide high-quality bespoke products that keep end users satisfied and loyal.

Using trusted partners to implement customer-centric solutions

Through platformification and analyzing historical and real-time customer data, banks can offer personalized services and create new revenue streams. Working with innovative fintechs and other innovative partners, they can connect more easily with their customers, anticipate current trends, and capitalize on the latest technologies.

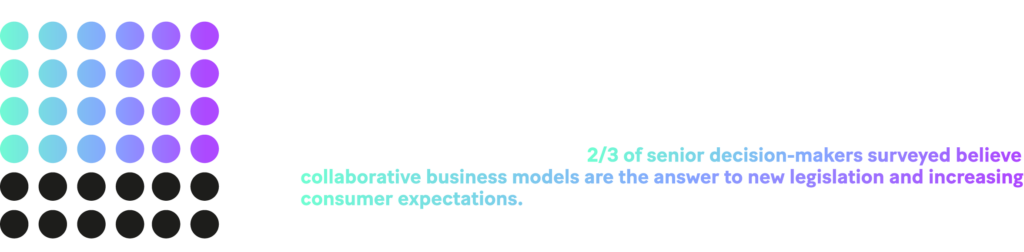

A study we conducted with Forrester – The Future Of Digital Banking, Revisited (2022) – revealed that in 2022, FIs planned to invest in ecosystem development, including open banking compliance and data exchange. Two-thirds of senior decision-makers surveyed believe collaborative business models are the answer to new legislation and increasing consumer expectations. Ironically, 74% of that group worries a new approach could pose an existential threat.

Regardless, there’s no turning back: Banks need assistance with their digital transformation, and quickly. As such, it’s no surprise that 76% believe collaboration is a foundational aspect of their roadmap and strategies.

The future is platformification

Through collaboration, FIs access the latest innovations without overhauling existing infrastructure. Meanwhile, by sharing data securely and efficiently, their customers benefit from a more varied offering alongside specialized products and services. However, to survive and thrive, financial institutions must choose the right platformification partners.

Sopra Banking Software has the necessary knowledge combined with innovative technology and highly trained industry experts to orchestrate digital ecosystems with ease. To find out more, check out our end-to-end financing platform.